Marketing for Financial Advisors: Building a Strong Digital Foundation

If you follow the research, roughly 80% of financial advisors have no defined marketing strategy.

What this statistic doesn’t reveal, however, is that many of the 20% who do have a strategy are still failing. It’s not because their tactics are wrong. They’re building their entire marketing efforts on a broken foundation.

Think about it this way. As an advisor, you wouldn’t advise a client to invest in individual stocks without first establishing a solid financial foundation. It’s uncomfortable for them to admit, but most advisors approach marketing exactly this way. They hire someone to start emailing market commentaries written by their broker-dealers. They post “Monday Motivations” and “Fun Fact Fridays” on social media (see 13 Bad Habits Financial Advisors Have on Social Media). They share blogs from shared content libraries without ensuring their digital foundation can actually convert the interest (if any) they generate.

The Foundation That Makes or Breaks Everything When Marketing an Advisory Business

Here’s the uncomfortable truth: you’ve built a successful practice without needing much of an online presence. Referrals came from relationships. Your expertise spoke for itself in face-to-face meetings. Your reputation was built through actual results, not digital marketing tactics. According to Kitces Research, 93% of advisors say client referrals are essential to their marketing strategy.

So when someone tells you that you need to be posting on LinkedIn three times a week or writing blogs about tax planning, it feels disconnected from how you actually built your business.

And honestly? They might be wrong about what you need.

When Minimal Online Presence Works

Not every advisory firm needs a robust content strategy or active social media presence. Consider how successful venture capital firms operate online. Their websites often serve simply as platforms for announcing developments and showcasing leadership, not as content repositories with complex SEO strategies. These firms understand that their reputation and results speak louder than constant content creation. Their minimal digital presence actually reinforces their focus on what matters most.

This same principle applies to many advisory practices. Some of the most successful advisors deliberately maintain minimal online presences, and prospects respect this approach. It signals that the firm dedicates its time to client service rather than self-promotion. There’s something to be said for the advisor whose website simply, clearly, and professionally communicates their expertise without trying to impress through volume of content (though, zero presence or an abrupt stop in contribution can raise questions as well).

In fact, firms that try too hard to puff up their online presence sometimes achieve the opposite effect. Constant posting, generic content, and over-the-top marketing can make even established firms look desperate for attention. At minimum, it signals distracted priorities. When evaluating service providers, many discerning prospects actually prefer working with firms that focus on substance over digital noise (see

The Power of Intentional Digital Presence

Here’s what has changed, regardless of your approach: every potential client, even those who come through trusted referrals, now researches advisors online before making contact. When your longtime client refers their colleague to you, that colleague won’t call your office first. Instead, they’ll Google your name and visit your website before making contact.

This is where intentionality becomes crucial. Whether you choose a minimal approach or decide to build authority through content, your digital presence must be deliberate. It should stay consistent with how you actually conduct business. A well-designed, communicative single page can be far more effective than a sprawling website filled with generic content that doesn’t reflect your actual approach or expertise.

The 50-Millisecond First Impression

The key is alignment. If you’re the type of advisor who prefers deep, focused relationships with a select group of clients, your website should reflect that approach. If you’ve built your practice on comprehensive financial planning for complex situations, your digital presence should communicate that specialization clearly and professionally.

Numbers tell the story. Research indicates that visitors form an opinion about your website in just 50 milliseconds. If your site looks outdated, loads slowly, or fails to clearly communicate your value proposition, you’ve lost them before they’ve even read a single word about your services. Meanwhile, 57% of visitors won’t recommend a business with a poorly designed website, meaning referral efforts get undermined before they begin.

Advisor Marketing Principle: All-In or All-Out

The biggest mistake advisors make isn’t choosing the wrong marketing strategy. It’s trying to be halfway committed to an approach that requires full commitment. Marketing experts tell you to be active on social media, so you start posting articles from shared content libraries. You grab whatever matches the week’s theme: tax planning this week, divorce planning next week, 529 plans the week after. Posts get little engagement, feel disconnected from your actual expertise, and create a cycle where you’re constantly searching for something to say rather than sharing genuine insights.

This halfhearted approach backfires in multiple ways. Search algorithms actively penalize inconsistent, generic content, which means fewer people see your posts over time. More importantly, shallow content creates an impression of inauthenticity that contradicts the trust-based relationships you’ve built your practice on. Prospects who encounter this generic content might question whether the advisor behind it truly understands their specific needs.

Making Deliberate Digital Choices

Instead, the solution is being more intentional about what you do choose to do. If you’re going to build authority through content, commit fully to sharing genuine expertise in ways that reflect your actual advisory approach. If you prefer to focus entirely on client service and referral relationships, then let your minimal but professional digital presence communicate that focus clearly.

Advisors successful with marketing don’t necessarily post frequently on social media or chase every digital trend. They make deliberate choices about their digital presence and execute those choices consistently. Some build authority through comprehensive content strategies. Others maintain minimal but highly professional online presences that reflect their focus on client service over self-promotion.

Both approaches can work, but only when they’re authentic to how the advisor actually operates. Making the mistake of trying to split the difference with halfhearted content creation satisfies neither approach. Whether you choose comprehensive authority-building or elegant simplicity, your digital presence should reinforce rather than contradict the way you’ve built your practice.

Consider how this plays out in practice. You write a thoughtful article about retirement planning that gets shared widely on LinkedIn. Interested prospects click through to learn more about you. However, they land on a generic homepage with no clear way to access more of your insights or schedule a conversation. Traffic you generated through your expertise evaporates because your website wasn’t designed to capture and nurture that interest.

Contrast this with an advisor whose website automatically captures visitor information in exchange for additional valuable content. It integrates with their CRM to track engagement and provides clear pathways for prospects to take the next step. That same LinkedIn article generates not just traffic, but qualified leads that can be systematically nurtured into clients.

The Integration Advantage

The most successful advisor marketing strategies don’t rely on individual tactics working in isolation. Instead, they create integrated systems where your website serves as the central hub. This connects and amplifies everything else you do.

From Guesswork to Strategic Decision-Making

When your website integrates seamlessly with your CRM, every visitor becomes a trackable opportunity. You can see which content resonates most, which referral sources generate the highest-quality leads, and which marketing efforts actually drive business growth.

This data transforms marketing from guesswork into strategic decision-making. In 2025, businesses that use CRM saw an increase of 41% in sales revenue and a 32% reduction in marketing costs.

Email marketing becomes exponentially more effective when your website automatically segments visitors based on their interests and behavior. Instead of sending generic newsletters to your entire list, you can deliver targeted content that speaks directly to each prospect’s specific needs and stage in the decision-making process.

Content marketing stops being a time-consuming exercise in hope when your website is optimized to turn readers into subscribers and subscribers into clients. Every blog post, every piece of educational content, and every valuable insight you share has clear calls-to-action that guide prospects toward working with you.

Event marketing becomes a dynamic pillar of your overall strategy when your website seamlessly integrates with your CRM. Whether you’re hosting live webinars, in-person workshops, or virtual conferences, every event registration turns into a trackable opportunity that allows you to capture detailed data about attendee behavior.

Even referrals become more effective when the people referring you know that prospects will land somewhere professional, informative, and conversion-focused. Referral sources become more confident sending people your way when they know those prospects will have a positive experience researching your services.

Understanding Client Acquisition Costs of Financial Advisors Marketing Strategies

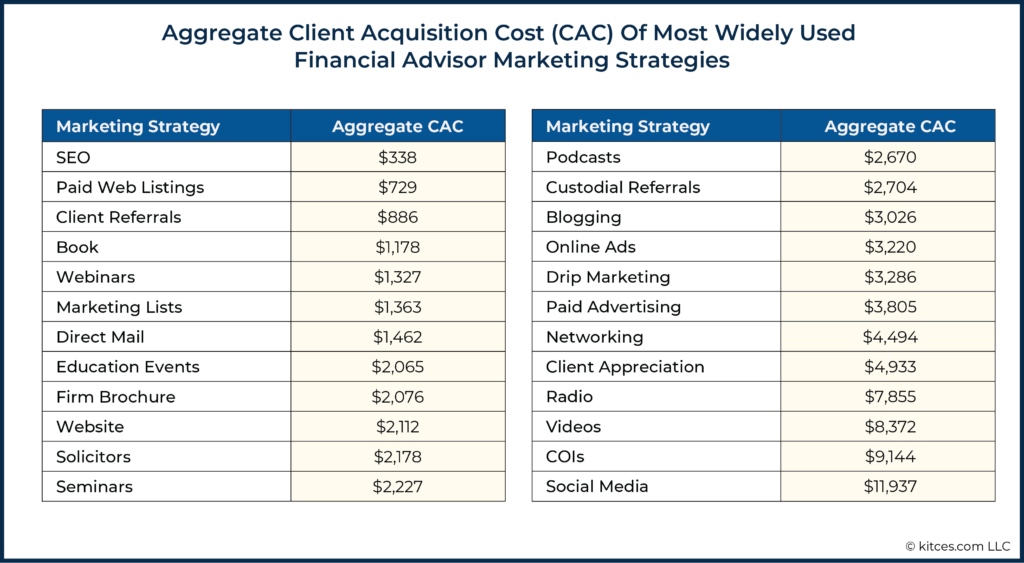

When you look at how much it costs to acquiring a client, Kitces Research produced a chart that simply cannot it simply cannot be understated that impact and costs vary widely.

When you look at the categories, SEO stands out for how relatively little it costs. But what really jumps out is that costs 1300% more gain a customer through social media (approx. $12,000) compared to a referral (less than $900)! And this gives no indication as to how profitable and easy to work with these clients are (which referrals tend to excel in these respects). Still, Putnam Investments concluded that 94% of financial advisors use social media for business purposes.

Marketing Compliance for Financial Advisors

Before implementing any marketing strategy, RIA firms and investment advisors must consider regulatory requirements. SEC and FINRA social media guidelines require that all marketing communications be fair, balanced, and not misleading. This means your website content, social media posts, and email marketing must comply with advertising rules.

The good news is that educational content and professional website presence typically align well with compliance requirements. Focus on providing valuable information rather than making performance claims or guarantees. Always maintain records of your marketing materials and consider having compliance review significant content before publication.

The Investment Reality: Marketing Budgets That Work

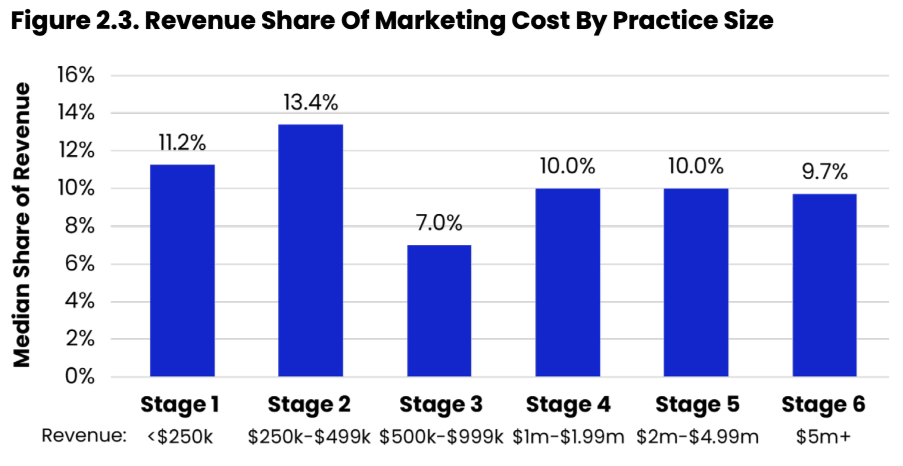

Many advisors wonder what they should realistically invest in marketing. Historical industry benchmarks suggest successful advisory firms allocate 2-4% of revenue to marketing activities. For a $1 million revenue practice, this translates to $20,000-$40,000 annually. However, revenue share of marketing costs are on the rise. A 2025 Kitces study of 450+ advisors revealed that advisors spent 11% of revenue on average, up from 7.1% the year prior (reported total average expenditure was just over $41,000).

However, the key isn’t just budget size: it’s allocation efficiency. A well-designed website foundation might cost $15,000-$25,000 initially but continues generating leads for years. Compare this to paid advertising that stops working the moment you stop paying. Most advisors see meaningful results within 6-12 months when they commit to an integrated approach rather than scattered tactics.

ROI expectations should be realistic. A properly optimized website typically generates 2-5 qualified leads per month for established advisors. Convert just one of those leads into a client annually, and the marketing investment pays for itself many times over.

The Compound Effect of Organic Growth

Just as you help clients understand the power of compound interest, successful advisor marketing leverages the compound effect of organic growth. When your website is properly optimized for search engines and consistently fed with valuable content, it begins attracting prospects without ongoing advertising spend.

Long-term vs. Short-term Marketing Thinking

Organic traffic (SEO) compounds over time. Each piece of content you create builds upon the last, improving your search rankings and establishing your expertise in your chosen niche. Unlike paid advertising that stops working the moment you stop paying, organic traffic continues generating leads months and years after you publish content.

Advisors who understand this approach their marketing with a long-term perspective. They invest in building a strong digital foundation that will continue paying dividends rather than constantly chasing the latest marketing tactics or paying for temporary visibility.

Beyond the Website: The Complete Digital Ecosystem

While your website serves as the foundation, truly effective advisor marketing requires thinking beyond the website itself. Consider the complete digital ecosystem that supports your growth. This means considering how every tool and system in your practice works together to create seamless experiences for prospects and clients alike.

Seamless Systems Integration

Your scheduling system should integrate with your website so interested prospects can immediately book consultations without friction. Your CRM should capture and organize every interaction so you never miss an opportunity to follow up. Your email marketing platform should connect with your website analytics so you understand which messages drive the most engagement.

An integrated approach transforms marketing for financal advisors from a series of separate activities into a cohesive system that works even when you’re focused on serving clients. Your system automatically sends prospects timely, relevant communications. Your CRM captures and organizes leads without manual data entry. Follow-up reminders ensure no opportunity falls through the cracks.

The Path Forward

Successful marketing advisors don’t necessarily post frequently on social media or chase every digital trend. They recognize that their decades of expertise already provide everything they need for authentic marketing. They don’t need to manufacture content or chase algorithms. They need a digital presence that authentically reflects their knowledge and makes it easy for prospects to understand their value and take the next step.

This means starting with a website that showcases your actual expertise and client success stories, not generic stock photos and templated content. It means having systems that capture and nurture the interest you’ve already earned through your reputation. And it means thinking strategically about how your digital presence supports the relationship-based business you’ve already built, rather than trying to replace it with tactics that feel foreign to your approach.

Those 80% of advisors without defined marketing strategies aren’t necessarily wrong to be hesitant. You’ve seen colleagues get caught up in social media posting schedules and content calendars that consume time without generating meaningful results. You’ve watched advisors become uncomfortable versions of themselves online, posting generic content that doesn’t reflect their actual expertise or client relationships.

But avoiding digital marketing entirely isn’t the answer either. Referrals still research you online. Your expertise still needs to be discoverable by the right prospects. Instead of spending hours a week creating content that’s seen by no one, invest in generating client reviews on Google and gathering client testimonials to build social proof. Additionally, your practice requires systems that work even when you’re focused on serving clients. Rather than becoming a content creator or social media personality, ensure your digital presence authentically represents the advisor you already are. It should make it effortless for the right prospects to choose you.

Your expertise as a financial advisor is already your greatest marketing asset. The question isn’t whether you have something valuable to offer, but whether your digital presence effectively communicates that value and converts interest into action. When you get the foundation right, everything else becomes not just easier, but exponentially more effective.